Our customer is one of the leading Banking firms in Nordics which offers multichannel products and services. They wanted to build a propensity model to understand their customer’s revenue life cycle and find the potential customer segments to upsell their additional services and products.

Requirements

- Understand customer demographics and how they are changing at a macro level.

- Robust to market changes and require less historical data of customers.

- Personalized in-depth ROI analysis for B2B customers to forecast and predict their revenue in affiliated branch accounts.

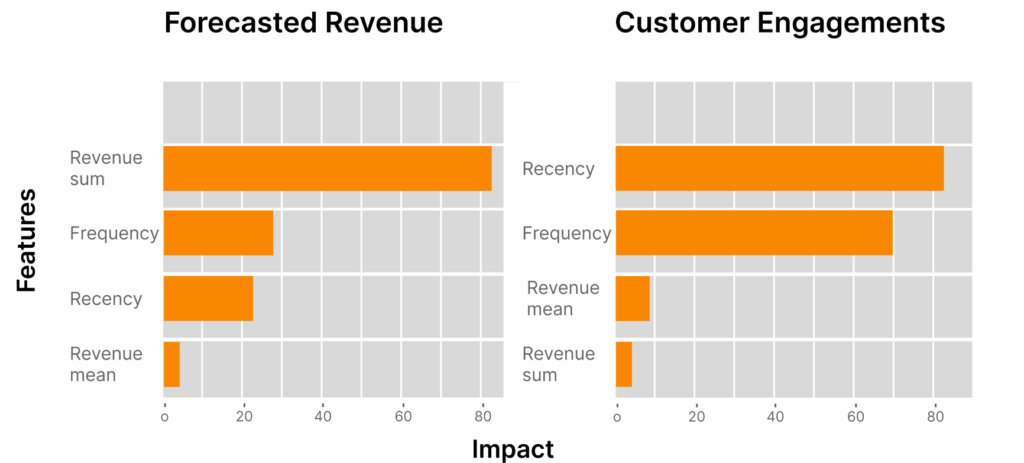

- Understanding the customer’s behavioral analysis based on the RFM parameters.

- Identify the customer segments where targeted marketing can be applied.

- Predict the campaign performance for the new products or services on clientele.

Challenges

- The complexity of the data leads to additional work in formulating and structuring the model to perform accurately

- Fulfilling different needs of customers based on business needs involves a huge volume of data and a longer processing time.

- Adhering to Data Governance policies to set the policy standards as per GDP.

- Modeling the use cases to support multiple cloud platforms and on-premises systems.

Solution Design

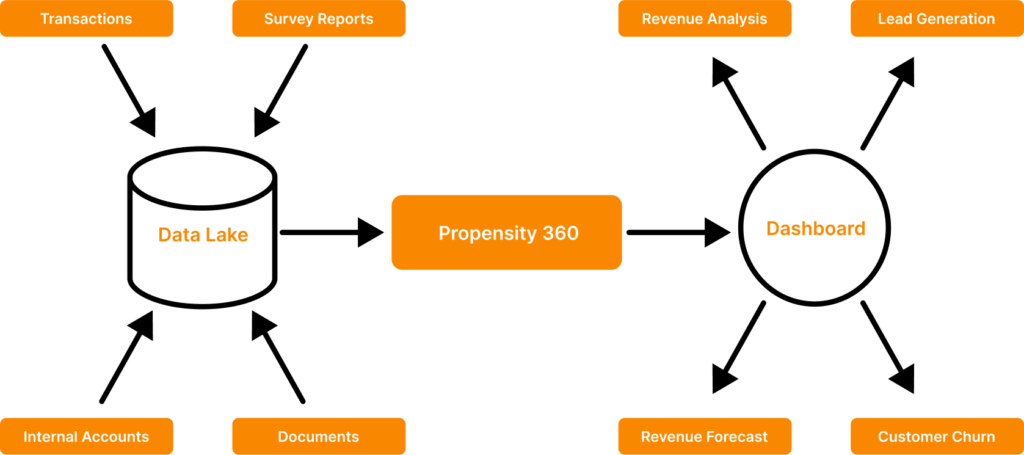

- The objective is to formulate and combine the different use cases such as Lead Conversion, Propensity to engage, Customer Lifetime Value, and Churn rate forecasting.

- To achieve an AI solution, we have processed millions of transactional, survey, and Ticket data to create multiple machine learning models to predict and forecast outcomes.

- To handle the huge volume of complex input data, we built a big data pipeline using specifically designed data structures on Apache Spark and the Hadoop platform which can import data from several sources.

- After structuring the data, we develop different KPIs depending on the business and customer modeling needs.

- We use clustering algorithms to differentiate customers on basis of characteristic features.

- The recency of transactions over a defined period, Frequency of the usage of products or services, and Monetary value of the transaction.

- We also account for clients’ purchase behavior, time taken to purchase, spending patterns, and social similarity groups.

- We employed multi-level ensemble modeling techniques to generate data-driven business insights limiting bias from the development team.

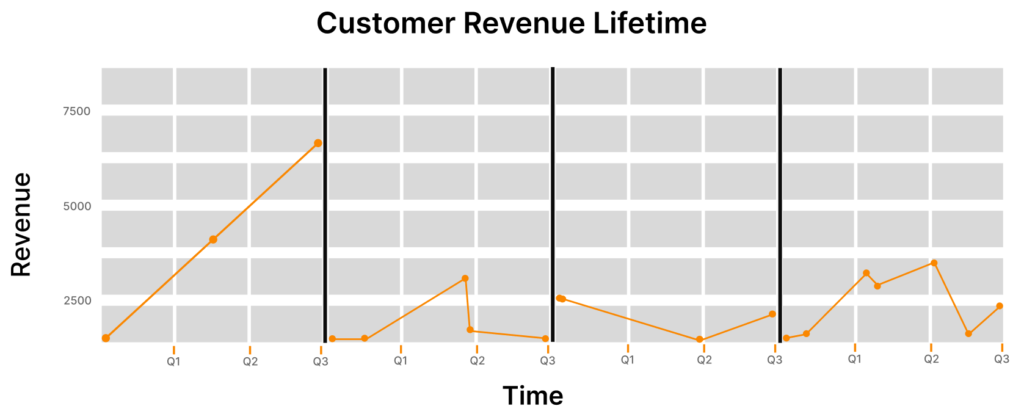

- With these insights, we were able to identify client microsegments and forecast the future revenues for individual microclusters, do behavioral analysis and check customer drift.

- We developed user-friendly, easy-to-understand dashboards to analyze observational changes in customer patterns and formulate new marketing strategies which improved ROI.

Business Value Addition

- Performing quasi-statistical experiments to research customer demographics and behavioral analysis to cater to the needs of customers improving customer retention.

- Achieving higher precision, recall, and F1 scores with improved modeling techniques.

- Explainable model outputs and formulating more effective relationships with data points (90% AUC).

- The propensity score matching was effectively applied across almost 90% of the client customer population including new customers, inactive clients, and those with less or close to zero historical data.

- Enhanced conversion rate up to 80% towards consumer product offering and better positioning.

- Cost reduction by 40% by early prediction of churn customers.

- Personalized product offerings tailored using propensity score with a significant increase in customer engagements.

- Detected potential churn and offered better services.

Author: Aniket Anil Chaudhary

Data Science